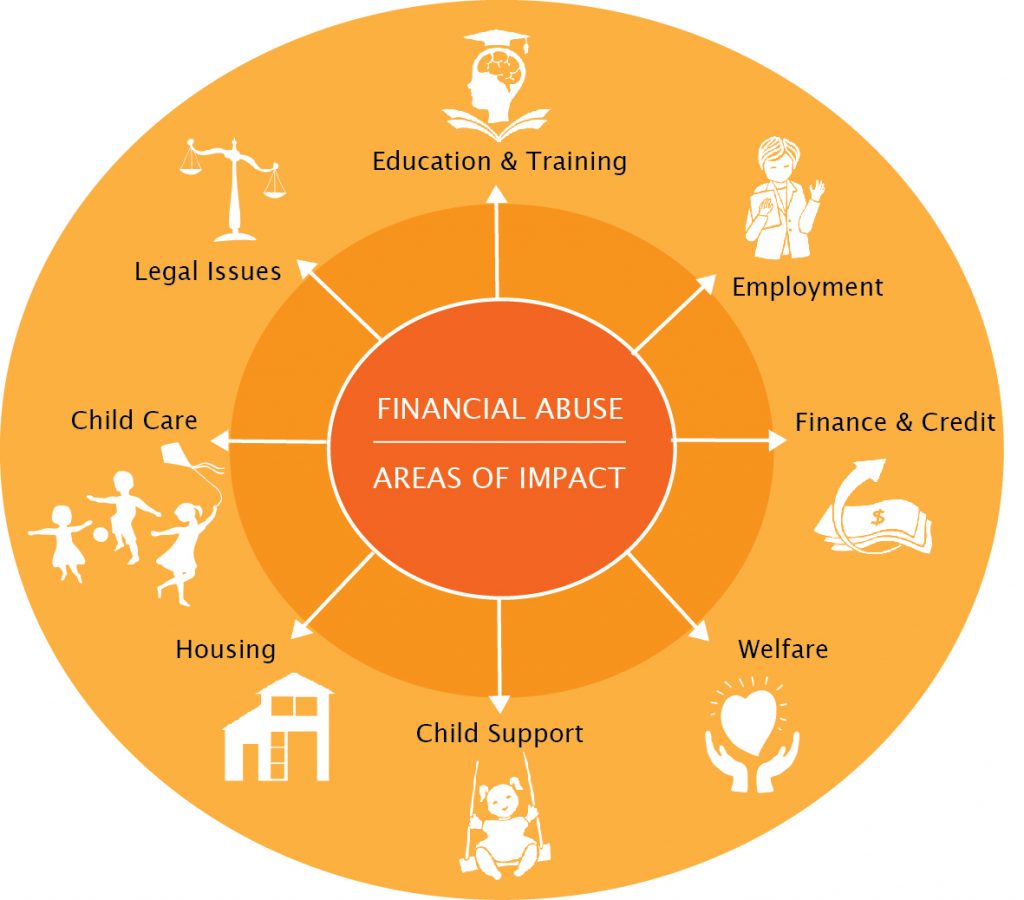

Recognising Financial Abuse

In this Key Learning Area we explore the many different forms that financial abuse can take and how to recognise the signs.

Introduction

Our chosen definition of financial abuse for the purpose of exploring this Topic, describes the behaviours of abusers in terms of ‘controlling, exploiting or sabotaging’ their partner’s (or victim’s) ability to aquire, use and maintain financial resources. In this Key Learning Area we will discuss potential signs of financial abuse in each of these three categories of behaviour.

signs of controlling behaviours

Some signs that financial abuse is occurring through controlling abuser behaviours include:

- controlling or withholding money or finances in a relationship e.g. a partner is forced to hand over their wages or government benefits

- having to ask for money to do the shopping or buy essentials and having to provide receipts and hand back any unspent funds

- using joint bank accounts to control access to money, or putting a partner’s money in their own or secret account

- excluding a partner from financial decision-making processes, or making a decision without properly consulting them or without having the proper authority

- threatening to disconnect essential services or utilities e.g gas, electricity, phone, internet

- coercing a partner into relinguishing control of their assets e.g. investment properties, inherited items, jewellery etc

- keeping information relating to the state of joint finances a secret

- using money, credit cards, or other valuables without consent

- controlling or refusing to pay child support payments; and

- coercing an ex-partner to either drop settlement proceedings or agree to an unfair settlement.

Can you Recognise the Signs of Economic Abuse?

ABC – The Drum (16.47 Mins)

signs of exploitative behaviours

Some signs that financial abuse is occurring through exploitative abuser behaviours include:

- putting bills into a partner’s name so they are liable for their payment

- sending money to other family members without a partner’s consent

- forging a partner’s signature to access money or property, or to falsify documents and approvals

- being asked to sign documents or transfer property into another person’s name or to take out a reverse mortgage on a home

- forcing early access to superannuation. This was particularly prevalent during the COVID-19 pandemic when individuals were able to access two withdrawals of up to $10,000.

- being pressured to make changes to a Will, Financial Power of Attorney or other legal documentation, without proper understanding

- creating joint debts and other liabilities which reduce a partner’s economic independence and ability to leave an abusive relationship

- abusing dowries and temporary visas; and

- cleaning out joint bank accounts prior to or after separation.

signs of sabotage behaviours

Some signs that financial abuse is occurring through sabotaging abuser behaviours include:

- preventing a partner from working or studying

- harassing a partner when they are at school or work

- damaging a partner’s financial security due to a poor credit rating (caused by not paying bills or meeting mortgage repayments), insolvency or bankruptcy

- refusing to contribute to household expenses e.g. a fair share of rent, bills and living costs

- deliberately causing housing insecurity by damaging property, or not making rent or mortgage payments

- refusing to contribute to the needs of children

- refusing to work

- cancelling or altering insurance policies, often coinciding with property damage

- coercing a partner to invest in a business, investment scheme or to transfer money into their account

- deliberately prolonging any legal proceedings; and

- refusing to make income declarations to Centrelink, therefore blocking access to childcare subsidies.

Reflection

Are you experiencing one or more of these abusive behaviours? If so, you may wish to start putting in place some risk management strategies, or seek advice and support from trusted third parties.

Financial Elder Abuse on the Increase and is ‘Extremely Common

ABC News (5.01 Mins)